What is a Revocable Living Trust?

v

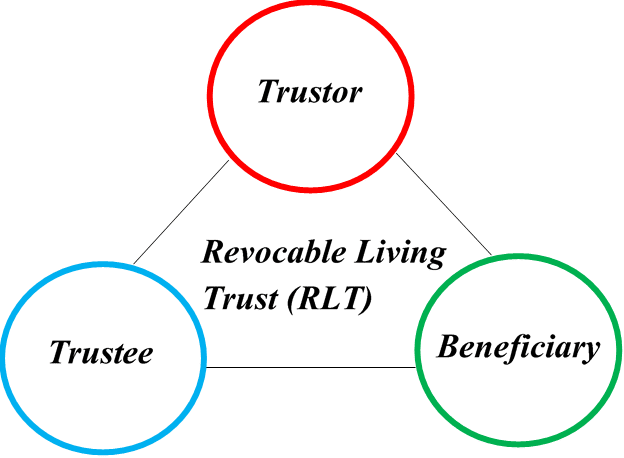

A Revocable Living Trust (“RLT”) is a written estate planning document by which the person who creates the Trust, referred to as the Trustor, names a person or corporate entity to manage assets transferred to the Trust during the lifetime of the Trustor and after the passing or death of the Trustor. The creation or establishment of a RLT is the creation of a new legal entity. The Trustor transfers ownership of some or all of the Trustor’s assets to the Trust during his or her lifetime. The assets owned by the RLT typically include the Trustor’s residence and financial accounts with more than just nominal balances. Retirement accounts, such as IRAs and 401(k)s are not usually transferred to the RLT. However, each situation is unique and the estate plan, which includes an RLT, should be tailored to the particular circumstances, goals, and assets of each individual. In most cases, the person who creates the Trust, the Trustor, as indicated above, is the person who acts as the Trustee during his or her lifetime. Therefore, the Trustor has complete control over the assets transferred to the Trust during the lifetime of the Trustor. The Trustee is responsible for carrying out the terms of the Trust. But, it is important for the Trustor to designate at least one alternate Trustee to act in the event of the Trustor’s incapacity or death. The alternate Trustee is usually referred to as the “Successor Trustee”. Elderly Trustees or those facing debilitating illnesses may select and name a person or entity to act as Trustee immediately upon creation of the Trust. Successor Trustees or alternate Trustees can be family members, close friends, colleagues, and/or professional fiduciaries such as banks and trust companies.

The RLT, like a Will, gives instructions about the transfer of assets after death. Unlike a Will, however, a RLT agreement creates a second legal entity upon signing which becomes the owner of some or all of the Trustor’s assets during the lifetime of the Trustor. If maintained properly, an RLT may be used to avoid a court probate proceeding when the Trustor dies. Usually, a Will called a “Pour-Over Will” is prepared at the same time as the RLT. The Pour-Over Will provides that any assets not transferred to the Trust during the lifetime of the Trustor are to pass to the Trust at the time of death.

The terms of the RLT can be changed any time, which is usually accomplished by amending the Trust document or if the changes are substantial, by restating and amending the Trust document in its entirety. Additionally, the RLT is revocable and may be cancelled at any time before the death of the Trustor.

Please contact the Estate Planning attorneys at Bruning & Associates, P.C. at 815-455-3000 to schedule your complimentary consultation to discuss your Revocable Living Trust.

Click here to learn more about Attorney Kevin Bruning.